UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to SectionPROXY STATEMENT PURSUANT TO SECTION 14(a)

of the Securities Exchange Act ofOF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )__)

Filed by the Registrant ☒

Filed by a Partyparty other than the Registrant ☐

Check the appropriate box:

☒ | Preliminary Proxy Statement |

☐ | Confidential, for |

☐ | Definitive Proxy Statement |

☐ | Definitive Additional |

☐ |

|

SOBR SAFE, INC. |

(Name of Registrant as Specified |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

☐ | Fee paid previously with preliminary materials. | |

☐ |

| |

|

| |

|

| |

|

| |

|

| |

SOBR SAFE, INC.Safe, Inc.

NOTICE OF 2024 ANNUAL MEETING OF

885 Arapahoe AvenueSTOCKHOLDERS & PROXY STATEMENT

Improvingbehavioraloutcomes&savingslives

6400 S. Fiddlers Green Circle | Suite 1400 | Greenwood Village, CO 80111 | Nasdaq: SOBR

PRELIMINARY PROXY STATEMENT – SUBJECT TO COMPLETION

SOBR Safe, Inc.

Boulder, CO 803026400 South Fiddlers Green Circle, Suite 1400

Greenwood Village, Colorado 80111

1.844.SOBRSAFE (762.7723)

NOTICE OF CONSENT SOLICITATIONANNUAL MEETING OF STOCKHOLDERS AND IMPORTANT NOTICE REGARDING

THE AVAILABILITY OF PROXY MATERIALS

November __, 2021To Be Held on June 3, 2024

Dear SOBR Safe, Inc. Stockholder:

The Board of DirectorsValued Stockholders of SOBR Safe, Inc., a Delaware corporation:

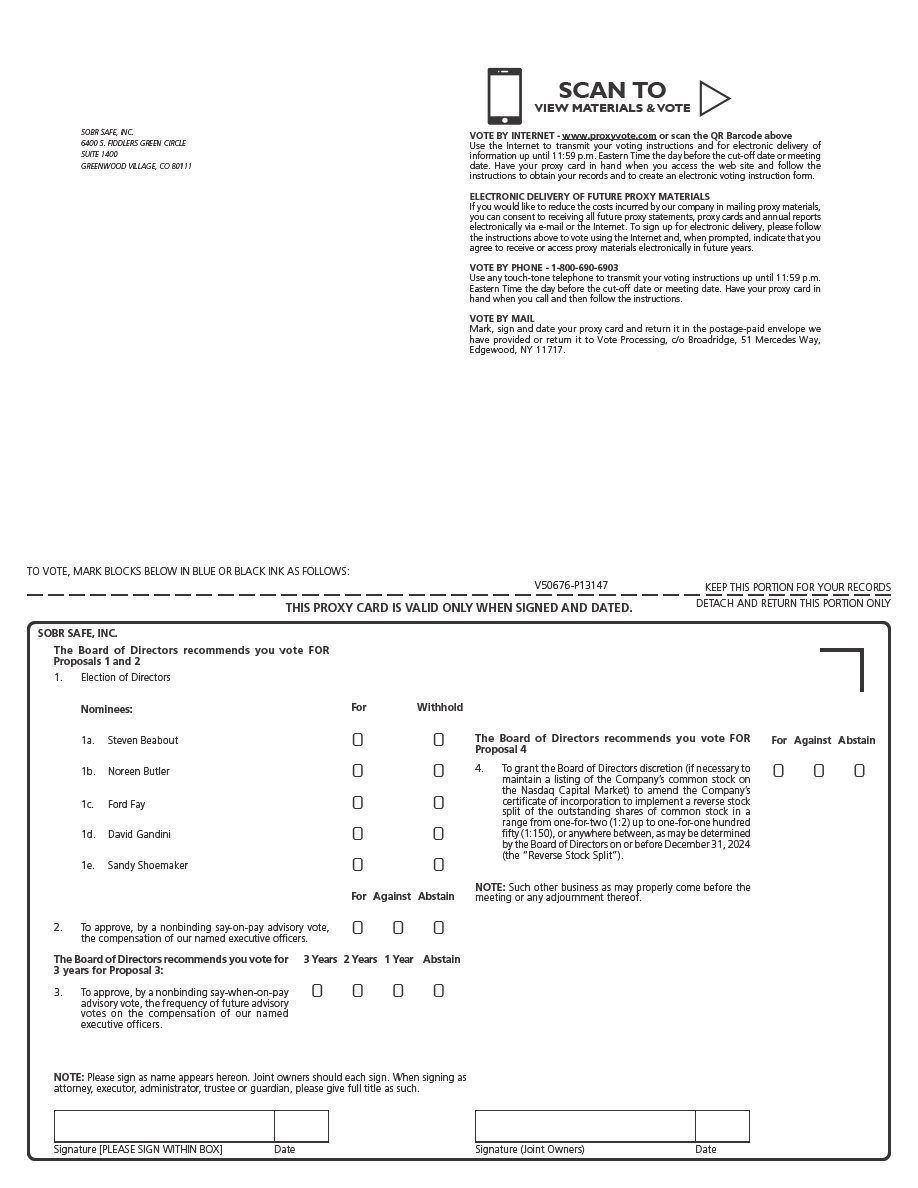

It is our pleasure to invite you to the 2024 Annual Meeting of Stockholders of SOBR Safe, Inc. (the “Company” or “we”) to be held virtually on Monday, June 3, 2024 at 1:00 P.M., is writing to solicit your consent on behalf ofMountain Time, via webcast at: ___________________ (the “Annual Meeting”). At the Annual Meeting, the Company to approvewill submit the following four (4) proposals (the “Proposals”):to its stockholders for approval:

| 1. | To |

|

|

|

| 2. | To approve, |

|

|

|

| 3. | To approve, |

|

|

|

| 4. | To |

The Company's Board of Directors unanimously approved the Reverse Stock Split, the Plan Amendment, and the Auditor Ratification on November 4, 2021. Each of theseAdditionally, any other matters is more fully discussed in the attached Consent Solicitation Statement.

In order to save the expense associated with holding a special meeting of the Company’s stockholders, the Board of Directors has elected to obtain stockholder approval by written consent (“Written Consent”) of the Proposals pursuant to Section 228 of the General Corporation Law of Delaware, rather than by calling a meeting of stockholders. The close of business on November 12, 2021 (the “Record Date”) has been fixed as the Record Date for the determination of holders of our Common Stock entitled to receive notice of and discretion to approve the Proposals.

This solicitation is being made on the terms and subjectmay be submitted to the conditions set forth instockholders as may properly come before the accompanying Consent Solicitation StatementAnnual Meeting and form of Written Consent. To be counted, your properly completed Written Consent must be received before 11:59 p.m. Eastern Time, on [__________], 2021 (the “Expiration Date”), subject to early termination of the Consent Solicitation,any adjournment or extension of the Expiration Date at the discretion of our Board of Directors.

Failure to submit the Written Consent will have the same effect as a vote against the Proposals. We recommend that all stockholders consent to the Proposals, by marking the box entitled “FOR” with respect to each Proposal and submitting the Written Consent by one of the methods set forth in the attached form of Written Consent. If you sign and send in the Written Consent form but do not indicate how you want to vote as to the Proposals, your consent form will be treated as a consent “FOR” each Proposal.

This is not a notice of a special meeting of stockholders and no stockholder meeting will be held to consider any matter that will be described herein.postponement thereof.

The discussion of the proposals set forth above is intended only as a summary and is qualified in its entirety by the information contained in the accompanying Proxy Statement. The accompanying Proxy Statement is being furnished to our stockholders for informational purposes only, pursuant to Section 14(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations prescribed thereunder. The Board will be soliciting your proxy in connection with the matters discussed above. Stockholders who wish to vote on the proposals accordingly must either virtually attend the Annual Meeting or otherwise designate a proxy to attend the Annual Meeting and vote on their behalf.

The Company is using the “Full Set Delivery” method of providing proxy materials to all stockholders. Because we have elected to utilize the “Full Set Delivery” option, we are delivering to all stockholders paper copies of the Company’s Proxy Statement, Annual Report on Form 10-K, and form of Proxy, as well as providing access to those proxy materials on a publicly accessible website. The Company’s Proxy Statement, Annual Report on Form 10-K, form of Proxy, and the other Annual Meeting materials are available on the internet at: www.proxyvote.com.

Other detailed information about us and our operations, including our audited financial statements, are included in our Annual Report on Form 10-K (the “Annual Report”) and can be accessed here: http:// www.sobrsafe.com.

The Board of Directors has fixed the close of business on April 24, 2024 as the record date (the “Record Date”) for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and at any adjournment or postponement thereof. Only holders of record of our common stock on the Record Date will be entitled to notice of and to vote at the Annual Meeting, and any postponements or adjournments thereof. There were no shares of Series B Convertible Preferred Stock outstanding on the Record Date. Stockholders of record virtually present at the Annual Meeting or who have submitted a valid proxy via the internet, or by mail may vote at the Annual Meeting.

Your vote is very important to us.Whether or not you expect to attend the Annual Meeting, please submit your proxy in advance online or by mail to ensure that your vote will be represented at the Annual Meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the Annual Meeting, you must obtain a proxy issued in your name from that record holder.

Please refer to the “Voting Instructions” section of the Proxy Statement for instructions on submitting your vote. Voting promptly will save us additional expense in further soliciting proxies and will ensure that your shares are represented at the Annual Meeting.

| By Order of the Board of Directors, | |

|

| |

|

| |

| /s/ David Gandini | |

| David Gandini | |

| Chairman of the Board and CEO | |

|

| Greenwood Village, Colorado |

|

| May __, 2024 |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ONJUNE 3, 2024: THE ANNUAL REPORT AND PROXY STATEMENT ARE AVAILABLE ONLINE AT: www.proxyvote.com.

PRELIMINARY PROXY STATEMENT – SUBJECT TO COMPLETION

SOBR SAFE, Inc.

6400 South Fiddlers Green Circle, Suite 1400

Greenwood Village, Colorado 80111

1.844.SOBRSAFE (762.7723)

PROXY STATEMENT

May __, 2024

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of SOBR Safe, Inc., a Delaware corporation (the “Company”), for use at the Company’s 2024 Annual Meeting of Stockholders to be held virtually on Monday, June 3, 2024 at 1:00 P.M., Mountain Time, via webcast at: ___________________ (the “Annual Meeting”) and any adjournment or postponement thereof.

Delivery of Proxy Materials and Annual Report

This Proxy Statement (including the Notice of Annual Meeting of Stockholders) is first being made available to stockholders beginning on or about May __, 2024. The Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, including financial statements (“Annual Report”), was filed with the Securities and Exchange Commission (the “SEC”) on April 1, 2024.

We are using the “Full Set Delivery” method of providing proxy materials to stockholders. Because we have elected to utilize the “Full Set Delivery” option, we are delivering to all stockholders paper copies of the Company’s Proxy Statement, Annual Report on Form 10-K, and form of Proxy, as well as providing access to those proxy materials on a publicly accessible website. The Company’s Proxy Statement, Annual Report on Form 10-K, form of Proxy, and the other Annual Meeting materials are available on the internet at: www.proxyvote.com.

Instructions for Attending Annual Meeting

Only stockholders of record at the close of business on April 24, 2024 will be entitled to vote at the Annual Meeting. To participate in and vote at the Annual Meeting, you must virtually attend the Annual Meeting via webcast at: ___________________, or submit your proxy in advance. The Annual Meeting will begin promptly at 1:00 P.M., Mountain Time, on June 3, 2024. Attendees of the Annual Meeting will be provided the opportunity to ask questions, subject to the Annual Meeting Rules of Conduct. The Chairman of the Annual Meeting has broad authority to conduct the meeting in an orderly manner.

| 1 |

SOBR SAFE, INC.

885 Arapahoe Avenue

Boulder, CO 80302

Telephone No. (844) 762-7723

_____________________________________________________________________________________________Voting Securities

CONSENT SOLICITATION STATEMENTThe specific proposals to be considered and acted upon at our Annual Meeting are each described in this Proxy Statement. Only holders of our common stock as of the close of business on April 24, 2024 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting. On the Record Date, there were 20,007,465 shares of common stock issued, and 19,995,136 shares outstanding. Each holder of common stock is entitled to one vote for each share of common stock held as of the Record Date. As a result, the holders of common stock are entitled to an aggregate of 19,995,136 votes. There were no shares of Series B Convertible Preferred Stock outstanding on the Record Date.

Cumulative voting shall not be allowed in the election of directors or any of the proposals being submitted to the stockholders at the Annual Meeting.

_____________________________________________________________________________________________Quorum

This Consent Solicitation Statement is being furnished in connection withIn order for any business to be conducted at the solicitationAnnual Meeting, a quorum must be present. The presence at the Annual Meeting, either virtually or by proxy, of written consentsholders of one-third of the stockholdersoutstanding shares of SOBR Safe, Inc.,the Company entitled to vote (6,665,046 shares) will constitute a Delaware corporation (the “Company”, “us”, “we”quorum for the transaction of business. If you submit a properly executed proxy, regardless of whether you abstain from voting on one or “our”) with regardmore matters, your shares will be counted as present at the Annual Meeting for the purpose of establishing a quorum. Shares that constitute broker non-votes will also be counted as present at the Annual Meeting for the purpose of establishing a quorum. If a quorum is not present at the scheduled time of the Annual Meeting, the Chairman of the Annual Meeting may adjourn the Annual Meeting until a quorum is present. The time and place of the adjourned Annual Meeting will be announced at the time the adjournment is taken, and no other notice will be given. An adjournment will have no effect on the business that may be conducted at the Annual Meeting.

Matters to the following proposals (the “Proposals”):be Voted Upon

There are four (4) matters scheduled for a vote:

| 1. | To |

|

|

|

| 2. | To approve, |

|

|

|

| 3. | To approve, |

|

|

|

| 4. | To |

| 2 |

At this time, the Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

Required Vote for Approval

1. Election of Directors. Directors are elected by a plurality vote. This means that the five director nominees who receive the greatest number of affirmative votes cast at the Annual Meeting by the shares present, either virtually or represented by proxy, and entitled to vote, will be elected. As to the election of the director nominees, you may vote “For” the election of the nominees, or “Withhold” for the nominees being proposed. Cumulative voting shall not be allowed in the election of directors.

2. Say-on-Pay. The “say-on-pay” advisory vote on the compensation of our named executive officers will be approved by the affirmative vote of a majority of the shares present or represented by proxy and entitled to vote at the Annual Meeting. However, while we intend to carefully consider the voting results of this proposal, the final vote is advisory in nature and therefore not binding on the Company. Our Board of Directors choose to seek stockholder approval by written consent ("Written Consent"), rather than calling a special meetingvalues the opinions of stockholders, in order to eliminate the costs and management time involved in holding a special meeting. Written Consents are being solicited from all of our stockholders and will consider the outcome when making future decisions with respect to executive compensation. As to the “say-on-pay” advisory vote on the compensation of record pursuant to Section 228our named executive officers, you may vote “For” or “Against” or “Abstain” from such proposal.

3. Say-when-on-Pay. The “say-when-on-pay” advisory vote on the frequency of future advisory votes on the compensation of our named executive officers is advisory in nature and therefore not binding on the Company. The option that receives the most votes will be deemed the preference of the General Corporation Lawstockholders, and our Board of Delaware, rather than by calling a meetingDirectors will consider the outcome when making future decisions with respect to the frequency of stockholders.advisory votes on executive compensation. As to the “say-when-on-pay” advisory vote on the frequency of future advisory votes on the compensation of our named executive officers, you may vote “Every Three Years,” “Every Two Years,” “Every One Year,” or “Abstain” from such proposal.

4. Reverse Stock Split. The proposal to grant the Board of Directors discretion (if necessary to maintain a listing of the Company’s common stock on the Nasdaq Capital Market) to amend the Company’s certificate of incorporation to implement a reverse stock split of the outstanding shares of common stock in a range from one-for-two (1:2) up to one-for-one hundred fifty (1:150), or anywhere between as may be determined by the Board of Directors on or before December 31, 2024 (the “Reverse Stock Split”) will be approved if the votes cast “For” the proposal exceed the votes cast “Against” the proposal. As to the approval of the Reverse Stock Split, you may vote “For” or “Against” or “Abstain” from such proposal.

| 3 |

Who May ConsentVoting Instructions

This Consent Solicitation StatementStockholders of Record: Shares Registered in Your Name

If on April 24, 2024, your shares were registered directly in your name with the Company’s transfer agent, EQ Shareowner Services, then you are a stockholder of record. As a stockholder of record, you may vote virtually at the Annual Meeting or by proxy in advance of the Annual Meeting by visiting www.proxyvote.com, completing and attached formreturning the proxy card by mail, or calling 1-800-690-6903.

Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy via the internet to ensure your vote is counted. You may still virtually attend the Annual Meeting and vote at the Annual Meeting even if you have already voted by proxy.

● | To vote at the Annual Meeting, attend the Annual Meeting virtually and you will be afforded an opportunity to vote via the internet. | |

● | To submit a proxy online in advance of the meeting, visit www.proxyvote.com. | |

● | To submit a proxy via telephone in advance of the meeting, call 1-800-690-6903. | |

● | To submit a proxy by mail, complete, sign and date the printed proxy card enclosed with the proxy materials, and return it promptly in the postage-paid envelope provided. If we receive your signed proxy card before the Annual Meeting, we will vote your shares as you direct. |

If your proxy is properly returned to the Company, the shares represented thereby will be voted at the Annual Meeting in accordance with the instructions specified thereon.

Beneficial Owner: Shares Registered in the Name of Written ConsentBroker or Bank

If on April 24, 2024, your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being mailedforwarded to eligible stockholders onyou by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or about November [__], 2021. On November 12, 2021,other agent regarding how to vote the record date forshares in your account. Simply complete the determination of stockholders entitledsteps included in the voting instruction form to act with respect to this Consent Solicitation (the “Record Date”), we had [____________] shares of Common Stock outstanding, each of which are entitled to act with respect to this Consent Solicitation. Each holder of Common Stockensure that your vote is entitled to one vote per share of Common Stock held. As of the Record Date, outstanding shares represented [____________] votes, all of which are attributable to our outstanding Common Stock.counted.

Stockholders who wishYou are also invited to consentattend the Annual Meeting. To vote at the Annual Meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker or bank included with these proxy materials or contact your broker or bank to the Proposals must return the attached form of Written Consent on or before 11:50 p.m. Eastern Time on December [__], 2021 (the “Expiration Date”). The Company expressly reserves the right, in its sole discretion and regardless of whether any of the conditions of the Consent Solicitation have been satisfied, subject to applicable law, at any time prior to Expiration Date to (i) terminate the Consent Solicitation for any reason, including if the consent of stockholders holdingrequest a majority of the Company’s outstanding shares has been received, (ii) waive any of the conditions to the Consent Solicitation, or (iii) amend the terms of the Consent Solicitation.proxy form.

| 4 |

Stockholders who wishAbstentions and Broker Non-Votes

An abstention represents a stockholder’s affirmative choice to consent must deliver their properly completeddecline to vote on a proposal. If a stockholder indicates on its proxy card that it wishes to abstain from voting its shares, or if a broker, bank or other nominee holding its customers’ shares of record causes abstentions to be recorded for shares, these shares will be considered present and executed Written Consentsentitled to vote, but not cast at the Corporate SecretaryAnnual Meeting. As a result, abstentions will be counted for purposes of determining the presence or absence of a quorum and will also count as votes against a proposal in cases where approval of the Companyproposal requires the affirmative vote of a majority of the shares present and entitled to vote at the Annual Meeting. Abstentions will have no effect where approval of the proposal requires the affirmative vote of a majority of votes cast.

A broker non-vote occurs when a broker, bank or other nominee holding shares for a beneficial owner does not vote on a particular proposal because the broker, bank or other nominee does not have discretionary voting power with respect to such proposal and has not received voting instructions from the beneficial owner of the shares. Broker non-votes will be counted for purposes of calculating whether a quorum is present at the Annual Meeting but will not be counted for purposes of determining the number of votes cast. Therefore, a broker non-vote will make a quorum more readily attainable but will not otherwise affect the outcome of the vote on any proposal.

Failure to Vote

If you are a stockholder of record and do not vote by proxy in accordanceadvance of the meeting, or vote at the Annual Meeting, your shares will not be voted.

If you are a beneficial owner and do not instruct your broker, bank, or other agent how to vote your shares, the question of whether your broker or nominee will still be able to vote your shares depends on whether the particular proposal is considered to be a routine matter under applicable rules. Brokers and nominees can use their discretion to vote “uninstructed” shares with respect to matters that are considered to be “routine” under applicable rules but not with respect to “non-routine” matters. Under applicable stock exchange rules and interpretations, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, elections of directors (even if not contested), executive compensation (including any advisory stockholder votes on executive compensation and on the frequency of stockholder votes on executive compensation), and certain corporate governance proposals, even if management-supported. Unless you provide voting instructions set forthto your broker, your broker or nominee may NOT vote your shares on the election of directors (Proposal 1), the “say-on-pay” advisory vote on executive compensation (Proposal 2), or the “say-when-on-pay” advisory vote on the frequency of advisory votes on executive compensation (Proposal 3), but may vote your shares on the Reverse Stock Split (Proposal No. 4).

Failure to Specify Vote

If you are a stockholder of record and return your proxy without specifying how the shares represented thereby are to be voted, the proxy will be voted (i) FOR the election of the five director nominees named in the attached form of Written Consent. The Company reserves the right (but is not obligated) to accept any Written Consent received by any other reasonable means or in any form that reasonably evidences the giving of consent to this Proxy Statement, (ii) FOR the approval of the Proposals.

compensation paid to the Company’s Named Executive Officers,IF YOU HOLD YOUR STOCK IN “STREET NAME”(iii) to conduct an advisory vote on executive compensation Every Three Years, YOU MUST INSTRUCT YOUR BROKER OR NOMINEE AS TO HOW TO VOTE YOUR SHARES. IF YOU FAIL TO DO SO, YOUR BROKER OR NOMINEE MAY NOT VOTE YOUR STOCK.(iv) FOR Any beneficial ownerthe Reverse Stock Split, and(v) at the discretion of the Company (normally thoseproxy holders who hold their shares in “street name” in a brokerage account) who is not a record holder must arrange withon any other matter that may properly come before the person who is the record holderAnnual Meeting or such record holder’s assigneeany adjournment or nominee to: (i) execute and deliver a Written Consent on behalf of such beneficial owner; or (ii) deliver a proxy so that such beneficial owner can execute and deliver a Written Consent on its own behalf.

Requests for copies of this Consent Solicitation Statement should be directed to SOBR Safe, Inc. at the address or telephone number set forth above.

Broadridge, will act as tabulation agent for this Consent Solicitation Statement. If you have any questions regarding your form of Written Consent, or if you need assistance voting your shares, please contact us directly at (844) 762-7723.

Consent Required

Stockholder approval of the Proposals will be effective upon receipt by us of affirmative Written Consents, not previously revoked, representing at least [____________] shares of our Common Stock as of the Record Date and entitled to act upon the Proposals. Accordingly, abstentions from submitting your Written Consent will have the effect of a vote “AGAINST” each Proposal.postponement thereof.

Revocation of ConsentsProxies; Changing Vote

You may withdrawrevoke or change you Written Consentyour proxy at any time before the Annual Meeting by (i) filing, with our Corporate Secretary at our executive offices, located at 6400 South Fiddlers Green Circle, Suite 1400, Greenwood Village, Colorado 80111 a notice of revocation of proxy; (ii) delivering a properly executed, later-dated proxy prior to the Expiration Date by submitting a written notice of revocation to the Company’s Corporate SecretaryAnnual Meeting; or (iii) voting at the address set forth above. A notice of revocationAnnual Meeting. Attendance at the Annual Meeting by itself will not revoke a proxy. Shares can be voted at the Annual Meeting only if the holder is present or withdrawal must specify the record stockholder’s name and the number of shares being withdrawn. After the Expiration Date, all written consents previously executed and delivered and not revoked will become irrevocable.

Absence of Appraisal Rights

Stockholders who abstain from approving of the Proposals, or who withhold consent of the Proposals, do not have the right to an appraisal of their shares of Common Stock, or any similar dissenters’ rights under the Delaware Corporate Law and our Articles of Incorporation and Bylaws.

Expenses of this Solicitation

This solicitation is being maderepresented by the Company’s Board of Directors, and the Company will bear the entire cost of the solicitation, including preparation, printing and mailing costs. Written Consents will be solicited principally through the mail, but our directors, officers and employees may solicit Written Consents personally, by phone or by e-mail. Arrangements will be made with brokerage firms and other custodians, nominees and fiduciaries to forward these consent solicitation materials to stockholdersproxy. If you are a stockholder whose shares of Common Stock are held ofnot registered in your own name, you will need additional documentation from your broker or record by such entities, and we will reimburse suck brokerage firms, custodians, nominees and fiduciaries for reasonable out-of-pocket expenses incurred by them in connection herewith. In addition, we may pay for and utilizeholder to vote at the services of individuals or companies we do not regularly employ in connection with this consent solicitation, if management determines it is advisable.Annual Meeting.

| 5 |

PROPOSALSNo Appraisal Rights

The stockholders of the Company have no dissenter’s or appraisal rights in connection with any of the proposals described herein.

Solicitation

Solicitation in connection with the Annual Meeting is made by the Company. We will bear the entire cost of solicitation, including the preparation, assembly, printing, mailing, and posting of this Proxy Statement, the Annual Report, and any additional solicitation materials furnished to stockholders. Copies of any solicitation materials will be furnished to brokerage houses, fiduciaries and custodians holding shares in their names that are beneficially owned by others so that they may forward this solicitation material to such beneficial owners. In addition, we may reimburse such persons for their costs in forwarding the solicitation materials to such beneficial owners. The original solicitation of proxies may be supplemented by a solicitation by telephone, e-mail, or other means by our directors, officers or employees. No additional compensation will be paid to these individuals for any such services. Except as described above, we do not presently intend to solicit proxies other than by e-mail, telephone, and mail.

Forward Looking Statements

This Proxy Statement may contain certain “forward-looking” statements, as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), in connection with the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties, as well as assumptions that, if they never materialize or prove incorrect, could cause our results to differ materially and adversely from those expressed or implied by such forward-looking statements.

Such forward-looking statements include statements about our expectations, beliefs or intentions regarding actions contemplated by this Proxy Statement, our potential business, financial condition, results of operations, strategies or prospects. You can identify forward-looking statements by the fact that these statements do not relate strictly to historical or current matters. Rather, forward-looking statements relate to anticipated or expected events, activities, trends or results as of the date they are made and are often identified by the use of words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” or “will,” and similar expressions or variations. Because forward-looking statements relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties that could cause our actual results to differ materially from any future results expressed or implied by the forward-looking statements. Many factors could cause our actual activities or results to differ materially from the activities and results anticipated in forward-looking statements. These factors include those described under the caption “Risk Factors” included in our other filings with the Securities and Exchange Commission (“SEC”), including the disclosures set forth in Item 1A of our Form 10-K for the year ended December 31, 2023. Furthermore, such forward-looking statements speak only as of the date of this Proxy Statement. We undertake no obligation to update any forward-looking statements to reflect events or circumstances occurring after the date of such statements.

| 6 |

MATTERS TO BE ACTED UPON BY STOCKHOLDERS:CONSIDERED AT THE ANNUAL MEETING

PROPOSALNO. 1

ELECTION OF DIRECTORS

Directors are normally elected byOur Bylaws provide that the shareholders at each annual meeting to hold office until their respective successors are elected and qualified, and need not be shareholdersnumber of directors that constitute the Company. Directors may receive compensation for their services as determined by the Board of Directors. See “Compensation of Directors.” Presently, theentire Board of Directors consists of six (6) members, namely David Gandini, Kevin Moore, Ford Fay, Steve Beabout, Jim Bardy and Sandy Shoemaker.

Voting for the election of directors is non-cumulative, which means that(the “Board”) shall be fixed from time to time by resolution adopted by a simple majority of the shares voting may elect allentire Board. Our Board currently consists of five directors, each of whom has been nominated by our Nominating and Corporate Governance Committee for election at the directors. Each share of common stock is entitled to one (1) vote and, therefore, has a number of votes equal toAnnual Meeting. The five director nominees for election at the number of authorized directors.Annual Meeting are:

· | Steven Beabout | |

· | Noreen Butler | |

· | Ford Fay | |

· | David Gandini | |

· | Sandy Shoemaker. |

Although

Each director nominee, if elected at the Company’s management expects that eachAnnual Meeting, will hold office for a one-year term until the next annual meeting of stockholders or until his or her successor is duly elected, unless prior thereto the following nominees will be availabledirector resigns, or the director’s office becomes vacant by reason of death or other cause. If any such person is unable or unwilling to serve as a director nominee at the date of the Annual Meeting or any postponement or adjournment thereof, the proxies may be voted for a substitute director nominee, designated by the proxy holders and subject to the rules for stockholder director nominations set forth in the event that any of them should become unavailable priorBylaws, or by the present Board to being appointed, a replacement will be appointed by a majority of the then-existingfill such vacancy. The Board of Directors. Management has no reason to believe that any of itssuch director nominees will be unwilling or unable to serve if elected will be unavailable to serve. All nominees are expected to serve until the next Annual Meeting of Shareholders or until their successors are duly elected and qualified.as a director.

Nominees For Election As DirectorVote Required

Directors will be elected by a plurality of the votes cast at the Annual Meeting. The five nominees receiving the highest number of affirmative votes will be elected. Abstentions and broker non-votes will have no effect on the outcome of the election of the directors.

Board of Directors Recommendation

THE BOARD RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE ELECTION OF STEVEN BEABOUT, NOREEN BUTLER, FORD FAY, DAVID GANDINI, AND SANDY SHOEMAKER.

DIRECTORS, DIRECTORNOMINEESAND EXECUTIVE OFFICERS

The following table sets forth certain informationthe names and ages of our directors, director nominees, and executive officers as of March 29, 2024, and the principal offices and positions with respect to persons nominatedthe Company held by each person. The directors serve one-year terms until their successors are elected. The executive officers of the Company are elected annually by the Board of DirectorsDirectors. The executive officers serve terms of one year or until their death, resignation, or removal by the Board of Directors. Unless described below, there are no family relationships among any of the Company for election as Directors of the Companydirectors and who will be elected following the effective date of the actions in this Consent Solicitation:officers.

Name |

| Age |

| Position(s) |

|

|

|

|

|

David Gandini |

|

|

| Chief Executive Officer, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ford Fay |

|

|

|

|

|

|

|

|

|

J. Steven Beabout |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sandy Shoemaker |

|

|

|

|

*Appointment effective November 10, 2021.

David Gandini

Mr. Gandini has served as our Chief Executive Officer since October 18, 2021, and our Chief Financial Officer since June 5, 2020, and on our Board of Directors since November 2019. Mr. Gandini has been consulting regarding our business development since December 2018. Since September 2018, Mr. Gandini has also been a managing partner with First Capital Advisory Services, where he is responsible for capital creation, new business acquisition, business strategy and development, and partnership revenue generation. From 2014 to August 2017, Mr. Gandini was President of Alchemy Plastics, Inc., Englewood Colorado where he was responsible for US manufacturing, sales, and strategic partnerships. From 2001 until 2014, when the company was acquired, Mr. Gandini served as the President of IPS Denver, a bank card personalization and packaging entity where he managed the company and market transformations to become a leader in the U.S. secured gift market space with revenues of $46M. Prior to his engagement at IPS, Mr. Gandini was the Chief Operations Officer at First World Communications, a major U.S. Internet and Data Center provider, and participated in its successful IPO in 2000 raising over $200M. Previously, Mr. Gandini founded Pace Network Services providing carrier SS7 signaling to U.S. long distance providers and facilitated a successful exit to ICG Communications on the heels of co-founding Detroit based Digital Signal in the fiber optic long haul market sector where me managed a successful exit to SP Telecom.

Mr. Gandini graduated from Michigan State University with a degree in Telecommunications. He was a scholarship NCAA Division Hockey athlete, a member of the US Junior National Team, and a US Junior All American.

We have an Employment Agreement with Mr. Gandini. Under the terms of his Employment Agreement, Mr. Gandini will serve as our Chief Revenue Officer until October 24, 2022, unless he is terminated pursuant to the termination provisions set forth in his agreement. Under the terms of his Employment Agreement, Mr. Gandini will perform services for us that are customary and usual for a chief revenue officer of a company, in exchange for: (i) an annual base salary of $185,000, (ii) sales bonuses based on the Company’s sales, (iii) an incentive stock options under our 2019 Equity Compensation Plan to acquire 721,588 shares of our common stock, at an exercise price of $0.2634, which is equal to 110% of the fair market value of our common stock on October 25, 2019, with the stock options to vest in 36 equal monthly installments of 20,045 shares during the three-year term of the Gandini Agreement, and (iv) an aggregate of 240,530 additional option shares (the “Pre-Vesting Option Shares”) shall vest as follows: 200,439 Pre-Vesting Option Shares representing the monthly vesting option shares for the ten months ended October 31, 2019, shall vest on November 1, 2019; and (ii) the remaining 40,091 Pre-Vesting Option Shares representing the monthly vesting option shares for the two months ended December 31, 2019 shall vest on January 1, 2020. The stock options have a ten year term.

Kevin Moore

Mr. Moore has served on our Board of Directors since November 2019 and served as our Chief Executive Officer from October 2019 to October 2021. Prior to his appointment as our Chief Executive Officer, Mr. Moore has been a private investor. From 2017 to 2019, Mr. Moore was the President of Moore Holdings, Inc. and Managing Member of Vans Silver Peaks, LLC. From 2014 to 2017, Mr. Moore was the Managing Member of Vans Equipment Denver LLC, Managing Member of Vans Equipment South LLC, Managing Member of Vans Silver Peaks LLC, and President of Moore Holdings, Inc. The Vans equipment companies are heavy equipment sale and rental companies, which initially started as a "greenfield" project during the Great Recession and grew to a very successful multi-location business serving the Colorado region. Prior to 2014, Mr. Moore was the President of Moore Holdings, Inc. and Managing Member of Vans Silver Peaks, LLC. Prior to joining Van’s Equipment Company, Mr. Moore was the Chief Executive Officer and owner of Summit Quality, an international quality management and sales organization that secured over $50 million per year in revenue for its clients. Prior to that endeavor, Mr. Moore was the Chief Executive Officer and owner of Automotive Testing Technologies. While in this position, he led a team that quadrupled testing revenue in four years, and then successfully sold the business to a competitor. Mr. Moore is currently an active business and real estate investor through Moore Holdings Incorporated.

| 7 |

Christopher Whitaker has served as our Chief Financial Officer since January 2024. Prior to his appointment as Chief Financial Officer, Mr. Moore serves onWhitaker served as the BoardCompany’s Vice President of DirectorsFinance and Accounting since February 2022. Mr. Whitaker has held various executive finance positions with large public multi-national corporations and small entrepreneurial companies throughout a progressive 30-year career that began with KPMG LLP in Denver, Colorado. Prior to joining the Company, Mr. Whitaker served as President - Americas and Vice President of Finance and Administration from February 2020 through June 2021 for SOBR Safe, Four Seasons Golf, RDM HoldingsNorth and South American operations with public, multinational corporation Elixinol, Inc. Through advancing executive roles, his responsibilities at Elixinol, Inc. included management of all financial and accounting operations, and leading marketing, sales, consumer product goods development, information technology, and human resource functions. Prior to Elixinol, Inc., Mr. Whitaker served as the Shining Stars Foundation. He also participatesManaging Director of AEGIS Financial Consulting, LLC, from January 2015 through January 2020, leading a team of consultants in providing fractional CFO and financial consulting services to a wide variety of businesses in the University of Colorado MBA mentorship programpublic and established the Shining Stars Young Adult mentorship program that supports young adults’ social and professional aspirations in a positive manner.private sectors.

Mr. Moore owns an incentive stock options under our 2019 Equity Compensation Plan to acquire 1,058,329 sharesWhitaker has been a Certified Public Accountant since 2014. He earned his Bachelor of our common stock, at an exercise priceScience degree in Accounting from the Metropolitan State University of $0.2634, which is equal to 110% of the fair market value of our common stock on October 25, 2019, with the stock options to vestDenver in 36 equal monthly installments of 29,398 shares during the three-year term of the Moore Agreement. The stock options have a ten year term.December 1999.

Ford B. Fay

Mr. Fay has served as a member of our Board of Directors since June 2020.2020 and serves as the Chairperson of the Nominating and Corporate Governance Committee of our Board of Directors. Mr. Fay is currently the Director at Crown Castle International Corp., a large fiber-based telecommunications company. In this position Mr. Fay manages all aspects of Network Access Life Cycle for the company. He has held this position since 2020. From 2017 to 2020, Mr. Fay was a principal with Eagle Bay Advisors, LLC, a telecommunications consulting firm. In this position, Mr. Fay assisted clients with cost and efficiency improvements in Access Management across the life cycle spectrum of Access. From 2015 to 2017, Mr. Fay was the Vice President, Access Management for Zayo Communications. In this position Mr. Fay created and managed most aspects of offnet costs, such as, vendor selection, contracting, procurement, quoting, operationalization, vendor management, offnet ordering, offnet grooming and optimization. In this position, Mr. Fay also planned and executed the network integrations of the $1.4B acquisition of Electric Lightwave and the $350M acquisition of Canadian-based Allstream. Mr. Fay received his Bachelor of Science in Operations Research & Industrial Engineering from Cornell University, and his Master of Business Administration from University of Rochester, Simon School of Business.

J. Steven Beabout

Mr. Beabout has served as a member of our Board of Directors since August 2020.2020 and serves as the Chairperson of the Compensation Committee of our Board of Directors. Since 2018, Mr. Beabout has been consulting with various startup companies and involved in real estate investing. From 2016-2018, Mr. Beabout was General Counsel of Tectonic, LLC, a SaaS company specializing in big data analytics and customer relationship management (CRM). In this position, Mr. Beabout was in charge of Tectonic’s legal department and negotiated deals with large companies like Coca-Cola, Anhueser-Busch and Wyndham Hotels. From 1996 to 2015, Mr. Beabout was General Counsel and a member of the strategic management team (executive vice-president) of Starz, a company listed on NASDAQ that competes with HBO and Netflix. During his time there, Mr. Beabout assisted with other key management personnel to grow the business from a start-up with $100M in losses to a multi-billion dollarmulti-billiondollar public company. As part of strategic management team, Mr. Beabout was involved in the company’s strategic business decisions and as General Counsel he was responsible for all legal aspects of business, including, but not limited to, negotiation of billion dollar plus contacts with major studios (Universal, Disney and Sony), and distributors (Comcast, Time- Warner, DIRECTV, DISH Networks, Netflix, etc.), human resources and related matters, general corporate matters, post-IPO public board matters, and reviewing filings with the Securities and Exchange Commission.

James Bardy Noreen Butler

Mr. Bardy has served as a member of our Board of Directors since August 2021. In 1989, Mr. Bardy formed Continental Services, where he currently serves as Executive Chairman of the Board. Continental Services is currently Michigan’s largest food management company, employing over 1,000 people and providing a wide range of custom dining, refreshment services and catering solutions through an impressive lineup of brands. Over the company’s 32-year history, Mr. Bardy has identified, negotiated, structured, financed, closed and successfully integrated 23 acquisitions. Mr. Bardy also applies his minor in Agribusiness to his North Florida cattle ranch, Great Mark Western, where 1,800 head of cattle are bred, raised managed and marketed specifically to high-end restaurant and food service clients. Mr. Bardy received his Bachelor of Science, Marketing and Transportation Major, Agribusiness Minor from Michigan State University.

Sandy Shoemaker

Ms. Shoemaker has served as a member of our Board of Directors since October 2022. Ms. Butler’s experience combines over 12 years in senior management and recruitment, following a 7-year career in business development. She is currently the Founder and Chief Executive Officer of RubiCorp Technologies, Inc., a private ridesharing company focused on safely transporting children ages 7+ for busy families and those in need of a safe, trusted ride. Previously, Ms. Butler had been involved in several companies in real estate, biotechnology and the technology industry, holding positions including Senior Advisor, Director of Business Development and Chief Executive Officer. From 2015 through June 2016, Ms. Butler was the Director of Business Development for Frozen Egg Bank Network, a division of global fertility company Donor Egg Bank. From 2016 to 2018, she was a Senior Advisor for Cresa, an international commercial real estate company. Ms. Butler has an undergraduate degree in Communications from Pine Manor College.

Sandy Shoemaker has served as a member of our Board of Directors since December 2021 and will chairserves as Chairperson of the audit committee of the Company’sour Board of Directors. Ms. Shoemaker retired from public accounting in June 2021 to focus on consulting with small-medium sized companies. She was a partner in the audit service area of EKS&H/Plante Moran and was involved in public accounting since 1990, serving publicly traded and privately held companies. She led the EKS&H SEC practice for several years. Ms. Shoemaker’s experience includes:includes initial and secondary public offerings, reverse mergers, annual and quarterly auditsaudits/reviews of public companies, responses to SEC comment letters, assisting with implementation of new accounting pronouncements, business acquisitions, stock-based compensation, and internal controls. Ms. Shoemaker has provided services to companies in the various industries such as bio-tech, franchising, distribution, manufacturing, medical-device, restaurants and real estate industries. She also has extensive experience in working with employee-owned companies.

Ms. Shoemaker has numerous professional affiliations including, but not limited to, American Institute of Certified Public Accountants (AICPA), the Colorado Society of Certified Public Accountants (CSCPA), and the National Center for Employee Ownership (NCEO). Ms. Shoemaker received her B.S. in Accounting, graduating cum laude, from Southwest Missouri State University.

| 8 |

|

Conflicts of InterestBOARD DIVERSITY

Potential conflicts of interest are inherent in the relationships between the Company and our officers and directors. From time to time, one or more of our affiliates may form or hold an ownership interest in and/or manage other businesses both related and unrelated to the type of business that we own and operate. These persons expect to continue to form, hold an ownership interest in and/or manage additional other businesses which may compete with our business with respect to operations, including financing and marketing, management time and services and potential customers. These activities may give rise to conflicts between or among the interests of us and other businesses with which our affiliates are associated. Our affiliates are in no way prohibited from undertaking such activities, and neither we nor our shareholders will have any right to require participation in such other activities. Further, because we intend to transact business with some of our officers, directors and affiliates, as well as with firms in which some of our officers, directors or affiliates have a material interest, potential conflicts may arise between the respective interests of us and these related persons or entities. We believe that such transactions will be effected on terms at least as favorable to us as those available from unrelated third parties.

With respect to transactions involving real or apparent conflicts of interest, we have adopted policies and procedures which require that: (i) the fact of the relationship or interest giving rise to the potential conflict be disclosed or known to the directors who authorize or approve the transaction prior to such authorization or approval, (ii) the transaction be approved by a majority of our disinterested outside directors, and (iii) the transaction be fair and reasonable to us at the time it is authorized or approved by our directors.

Our policiesfive directors come from diverse backgrounds. We comply with Nasdaq Listing Rule 5605(f), which requires Nasdaq-listed smaller reporting companies to have at least two diverse directors.

The table below provides certain highlights of the composition of our Board members and procedures regarding transactions involving potential conflictsnominees as of interest areMarch 29, 2024 and March 14, 2023. Each of the categories listed in the table below has the meaning as it is used in Nasdaq Listing Rule 5605(f).

Board Diversity Matrix | ||||||||||||||||||||||||||||||||

|

| (As of March 29, 2024) |

|

| (As of March 14, 2023) |

| ||||||||||||||||||||||||||

Total Number of Directors |

|

| 5 |

|

|

| 5 |

| ||||||||||||||||||||||||

|

| Female |

|

| Male |

|

| Non-Binary |

|

| Did Not Disclose Gender |

|

| Female |

|

| Male |

|

| Non-Binary |

|

| Did Not Disclose Gender |

| ||||||||

Gender Identity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Directors |

|

| 2 |

|

|

| 3 |

|

|

| — |

|

|

| — |

|

|

| 2 |

|

|

| 3 |

|

|

| — |

|

|

| — |

|

Demographic Background |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

African American or Black |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

Alaskan Native or Native American |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

Asian |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

Hispanic or Latinx |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

Native Hawaiian or Pacific Islander |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

White |

|

| 2 |

|

|

| 3 |

|

|

| — |

|

|

| — |

|

|

| 2 |

|

|

| 3 |

|

|

| — |

|

|

| — |

|

Two or More Races or Ethnicities |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

LGBTQ+ |

|

| — |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| — |

|

|

|

|

| |

Did Not Disclose Demographic Background |

|

| 5* |

|

|

| 5* |

| ||||||||||||||||||||||||

* Did not in writing. We understand that it will be difficultdisclose with respect to enforce our policies and procedures and will rely and trust our officers and directors to follow our policies and procedures. We will implement our policies and procedures by requiring the officer or director who is not in compliance with our policies and procedures to remove him and the other officers and directors will decide how to implement the policies and procedures, accordingly.LGBTQ+ background.

| 9 |

Involvement in Certain Legal ProceedingsDIRECTOR NOMINATIONS

ToThe Board nominates directors for election at each annual meeting of stockholders, appoints new directors to fill vacancies when they arise, and has the bestresponsibility to identify, evaluate and recruit qualified director candidates to the Board for such nomination or appointment.

The Nominating and Corporate Governance Committee identifies director nominees by first considering those current members of the Board who are willing to continue service. Current members of the Board with skills and experience that are relevant to our business and who are willing to continue service are considered for re-election, balancing the value of continuity of service by existing members of the Board with that of obtaining a new perspective. After being nominated by the Nominating Committee, director nominees are selected by a majority of the members of the Board. Although the Company does not have a formal diversity policy, in considering the suitability of director nominees, both the Nominating Committee and the Board consider such factors as they deem appropriate to develop a Board that is diverse in nature and comprised of experienced and seasoned advisors. Factors considered by the Nominating and Corporate Governance Committee and the Board include judgment, knowledge, noneskill, diversity, integrity, experience with businesses and other organizations of comparable size, including experience in law enforcement, the use of force product industry, intellectual property, business, corporate governance, marketing, finance, administration or public service, the relevance of a candidate’s experience to our needs and experience of other Board members, experience with accounting rules and practices, the desire to balance the considerable benefit of continuity with the periodic injection of the fresh perspective provided by new members, and the extent to which a candidate would be a desirable addition to the Board and any committees of the Board.

A stockholder who wishes to suggest a prospective director nominee for the Board may notify the Corporate Secretary of the Company in writing with any supporting material the stockholder considers appropriate. Director nominees suggested by stockholders are considered in the same way as director nominees recommended by other sources.

Term of Office

Our directors hold office until the next annual meeting or until their successors have been elected and qualified, or until they resign or are removed. Our Board of Directors appoints our officers, and our officers hold office until their successors are chosen and qualify, or until their resignation or their removal.

Family Relationships

There are no family relationships among our directors orand executive officers.

INVOLVEMENT IN CERTAIN LEGAL PROCEEDINGS

Our directors and executive officers has been convicted in a criminal proceeding, excluding traffic violations or similar misdemeanors, or has been a party to any judicial or administrative proceeding during the past five years that resulted in a judgment, decree, or final order enjoining the person from future violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation of federal or state securities laws, except for matters that were dismissed without sanction or settlement. Except as set forth in our discussion below in “Certain Relationships and Related Transactions, and Director Independence – Transactions with Related Persons,” none of our directors, director nominees, or executive officers hashave not been involved in any transactions with usof the following events during the past ten years:

1. | Other than the involuntary bankruptcy proceeding mentioned herein, no bankruptcy petition has been filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; | |

2. | Any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); | |

3. | Being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; | |

4. | Being found by a court of competent jurisdiction (in a civil action), the Securities and Exchange Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated; |

| 10 |

5. | Being the subject of, or a party to, any federal or state judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of: (i) any federal or state securities or commodities law or regulation; or (ii) any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order; or (iii) any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or |

6. | Being the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Securities Exchange Act of 1934), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

On January 22, 2024, the Company was named as a party to a complaint filed in Oakland County Court, Michigan by a former employee. The case was initially filed in the 6th Judicial District Circuit of Michigan. However, on February 15, 2024, the case was removed to the Federal Courts. The former employee is claiming breach of contract, unlawful termination and promissory estoppel. The Company has denied these claims.

There are no other material proceedings to which any director, officer, owner of record or beneficially of more than five percent of any class of voting securities, affiliate of the Company, or any associate of any such director, officer, security holder, or affiliate is a party adverse to the Company or any of our directors, executive officers, affiliates,its subsidiaries or associates which are required to be disclosed pursuanthas a material interest adverse to the rules and regulationsCompany of the Commission.any of its subsidiaries.

Historical Compensation of DirectorsBOARD AND COMMITTEE MEETINGS

Other than as set forth herein no compensation has been given to anyOur Board of Directors held four meetings during the year ended December 31, 2023, which occurred on March 15, 2023, May 5, 2023, August 4, 2023, and November 10, 2023; and all directors attended 100% of the aggregate number of meetings of the Board and of the committees on which each of the directors although they may be reimbursed for any pre-approved out-of-pocket expenses.served. The Board also acted by unanimous written consent six times since January 1, 2023.

COMMITTEES

Since April 22, 2022, our Board of Directors has a designated Compensation Committee, consisting of Steven Beabout and Ford Fay. Our Board of Directors has a designated Audit Committee, consisting of Sandy Shoemaker, Steve Beabout and Ford Fay. Our Board of Directors has a Nominating and Corporate Governance Committee, consisting of Ford Fay and Steve Beabout. We also have written charters for the Nominating and Corporate Governance, Compensation Committee and Audit Committee. The written charters can be found on our website at www.sobrsafe.com/corporate-policies/.

ComplianceAudit Committee

The primary role of the Audit Committee is to assist with Section 16(a)the financial oversight of the Company, which primarily includes the accounting, financial reporting, and audits of the financial statements of the Company.

The Nasdaq Capital Market rules require us to have, subject to certain exceptions, three independent Audit Committee members, with at least one member being an “audit committee financial expert”. Our Board of Directors has affirmatively determined that Sandy Shoemaker meets the definition of “independent director” and an “audit committee expert”, and Steven Beabout and Ford Fay qualify as “independent directors” for purposes of serving on an Audit Committee under Rule 10A-3 of the Securities Exchange Act of 1934, as amended, and Nasdaq Capital Market rules.

Our Audit Committee has held five meetings since January 1, 2023, which occurred on February 20, 2023, May 9, 2023, August 4, 2023, October 27, 2023, and March 28, 2024, and all members attended each meeting. The Audit Committee acted by unanimous written consent 0 times since January 1, 2023.

| 11 |

Compensation Committee

The primary role of the Compensation Committee is to oversee the Company’s overall executive compensation philosophy, policies and programs, and to determine, or recommend to the Board for determination, the compensation of the executive officers of the Company. Further discussion relating to the processes and procedures for the consideration and determination of executive compensation is described under Proposal 2 below.

The Nasdaq Capital Market rules require us to have two independent Compensation Committee members. Our Board of Directors has affirmatively determined that Steve Beabout and Ford Fay meets the definition of “independent director” for purposes of serving on a compensation committee under Rule 10A-3 of the Securities Exchange Act of 1934, as amended, and Nasdaq Capital Market rules.

Our Compensation Committee has held three meetings since January 1, 2023, which occurred on February 20, 2023, August 4, 2023 and October 27, 2023, and all members attended each meeting. The Compensation Committee acted by unanimous written consent 0 times since January 1, 2023.

Nominating and Corporate Governance Committee

The primary role of the Nominating and Corporate Governance Committee is to identify and recommend to the Board individuals qualified to become members of the Board (consistent with criteria the Board has approved). Further discussions of this process are described under “Director Nominations” above.

The Nasdaq Capital Market rules require us to have two independent Nominating and Corporate Governance Committee members. Our Board of Directors has affirmatively determined that Ford Fay and Steve Beabout meets the definition of “independent director” for purposes of serving on a Nominating and Corporate Governance Committee under Rule 10A-3 of the Securities Exchange Act of 1934, as amended, and Nasdaq Capital Market rules.

Our Nominating and Corporate Governance Committee held three meetings since January 1, 2023, which occurred on February 20, 2023, August 4, 2023 and October 27, 2023, and all members attended each meeting. The Compensation Committee acted by unanimous written consent 0 times since January 1, 2023.

Stockholder Communications

Stockholders who are interested in communicating directly with members of the Board of Directors may do so by writing directly to the individual Board members c/o Secretary, SOBR Safe, Inc., 6400 S. Fiddlers Green Cir., Suite 1400, Greenwood Village, Colorado 80111. The Company’s Secretary will forward communications directly to the appropriate Board member. If the correspondence is not addressed to the particular member, the communication will be forwarded to a Board member to bring to the attention of the Board. The Company’s Secretary will review all communications before forwarding them to the appropriate Board member.

Role of Board of Directors in Risk Oversight

While management is charged with the day-to-day management of risks that the Company faces, the Board of Directors and the Audit Committee are responsible for oversight of risk management. The full Board, and the Audit Committee since it was formed, have responsibility for general oversight of risks facing the Company. Specifically, the Audit Committee is tasked with periodically discussing policies with respect to risk assessment and risk management, and the Company’s plans to monitor, control and minimize such risks and exposures, with the independent public accounting firm, internal auditors and management.

Cybersecurity

We have a cross-departmental approach to addressing cybersecurity risk, including input from employees and our Board of Directors (the “Board”). The Board, Audit Committee, and senior management devote significant resources to cybersecurity and risk management processes to adapt to the changing cybersecurity landscape and respond to emerging threats in a timely and effective manner. Assessing, identifying, and managing cybersecurity related risks are integrated into our overall enterprise risk management (ERM) process. We have a set of Company-wide policies and procedures outlined in our Employee Handbook that directly or indirectly relate to cybersecurity risks. These policies go through an internal review process and are approved by appropriate members of management.

The Company’s EVP of Technology is responsible for developing and implementing our information security program and reporting on cybersecurity matters to the Board. Our EVP of Technology has over two decades of experience as a senior executive in technology-driven enterprises with expertise across cybersecurity, compliance, manufacturing process engineering, database architecture, interface programming and more.

The Company assesses the cybersecurity preparedness of third-party vendors by obtaining SOC 1 or SOC 2 reports. If a third-party vendor is not able to provide a SOC 1 or SOC 2 report, we take additional steps to assess their cybersecurity preparedness and assess our relationship on that basis. Our assessment of risks associated with the use of third-party providers is part of our overall cybersecurity risk management framework.

The Board and Audit Committee participates in discussions with management regarding cybersecurity risks and performs a review at least annually of the Company’s cybersecurity program. This includes discussions of management’s actions to identify and detect threats, as well as planned actions in the event of a response or recovery situation.

We are subject to cyber incidents and will continue to be exposed to cyber incidents in the normal course of our business. Although, such risks have not materially affected us, including our business strategy, financial condition, results of operations, or cash flows. The extensive approach we take to cybersecurity may not be successful in preventing or mitigating a cybersecurity incident that could have a material adverse effect on us. See Item 1A – Risk Factors for a discussion of cybersecurity risks.

| 12 |

CODE OF ETHICS

On April 22, 2022, our Board of Directors adopted a code of business conduct and ethics applicable to our employees, directors and officers, in accordance with applicable U.S. federal securities laws and the corporate governance rules of Nasdaq. The code of business conduct and ethics is publicly available on our website at www.sobrsafe.com/corporate-policies/. Any substantive amendments or waivers of the code of business conduct and ethics or code of ethics for senior financial officers may be made only by our Board of Directors and will be promptly disclosed as required by applicable U.S. federal securities laws and the corporate governance rules of Nasdaq.

Additionally, we adopted a policy on insider trading which is publicly available on our website at www.sobrsafe.com/corporate-policies/. The Insider Trading Policy also specifically addresses hedging transactions, providing that any person wishing to enter into such an arrangement must first obtain written pre-clearance from the designated Compliance Officer. However, if any hedging transaction is considered a short-sale, it will be prohibited. In any event, no director or officer of SOBR Safe is permitted to purchase financial instruments, including, for greater certainty, prepaid variable forward contracts, equity swaps, collars, or units of exchange funds that are designed to hedge or offset a decrease in market value of any SOBR Safe securities granted as compensation or held, directly or indirectly, by such director or executive officer.

CLAWBACK POLICY

In accordance with the applicable rules of the Nasdaq Stock Market and Section 10D and Rule 10D-1 of the Securities Exchange Act of 1934, as amended, the Company has adopted a policy for the recovery of erroneously awarded incentive-based compensation from executive officers (a “Clawback Policy”). In the event of an Accounting Restatement, the Company will reasonably promptly recover erroneously awarded compensation received from executive officers in accordance with the Nasdaq Rules and Rule 10D-1.

SECTION 16(A) BENEFICIAL OWNERSHIP

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s directors, and executive officers and persons who own more than ten percent of a registered class of the Company’s equity securities to file with the SEC initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Company. Officers, directors and greater than ten percent shareholders are required by the CommissionSEC regulations to furnish the Company with copies of all Section 16(a) forms they file.

DELINQUENT SECTION 16(A) REPORTS

During the most recent fiscal year, to the Company’s knowledge, the following delinquencies occurred:

Name |

No. of Late Reports | No. of Transactions Reported Late | No. of Failures to File |

David Gandini | 0 | 0 | 1 |

Kevin Moore | 0 | 0 | 0 |

Ford Fay | 0 | 0 | 0 |

J. Steven Beabout | 0 | 0 | 1 |

James Bardy | N/A | N/A | N/A |

Sandy Shoemaker | N/A | N/A | N/A |

Board Meetings and Committees

During 2021 and 2020, the Board of Directors met as circumstances required and took written action on numerous other occasions. All the members of the Board attended the meetings and all written actions were by unanimous consent.

Code of Ethics

We have not adopted a written code of ethics, because we believe and understand that our officers and directors adhere to and follow ethical standards without the necessity of a written policy.

Audit Committee

We do not currently have an audit committee. However, we will be forming an audit committee chaired by Sandy Shoemaker in connection with our planned listing on NASDAQ.

Compensation Committee

We currently have a compensation committee consisting of Steve Beabout and Ford Fay, which is chaired by Steve Beabout.

Name | No. of Late Reports | No. of Transactions Reported Late | No. of Failures to File |

David Gandini | 0 | 0 | 0 |

Jerry Wenzel | 0 | 0 | 0 |

Ford Fay | 0 | 0 | 1 |

Steven Beabout | 0 | 0 | 0 |

Noreen Butler | 0 | 0 | 0 |

Sandy Shoemaker | 0 | 0 | 0 |

Gary Graham | 0 | 0 | 18 |

Indemnification of Directors and Officers

Section 1 of Article VI of our Articles of Incorporation provides that, to the fullest extent permitted by the General Corporation Law of the State of Delaware we will indemnify our officers and directors from and against any and all expenses, liabilities, or other matters.

Section 2 of Article VI of our Articles of Incorporation provides that, to the fullest extent permitted by law, no director or officer shall be personally liable to the corporation or its shareholders for damages for breach of any duty owed to the corporation or its shareholders.

Article XI of our Amended and Restated Bylaws further addresses indemnification of our directors and officers and allows us to indemnify our directors and officers in the event they meet certain criteria in terms of acting in good faith and in an official capacity within the scope of their duties, when such conduct leads them to be involved in a legal action.

Insofar as indemnification for liabilities arising under the Securities Act of 1933 (the “Act”) may be permitted to directors, officers and controlling persons of the small business issuer pursuant to the foregoing provisions, or otherwise, the small business issuer has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable.

EXECUTIVE OFFICERS AND DIRECTORS; EXECUTIVE COMPENSATION

The particulars of compensation paid to the following persons:

|

| |

|

| |

|

|

who we will collectively refer to as the named executive officers, for the years ended December 31, 2020 and 2019, are set out in the following summary compensation table:

Executive Officers and Directors

The following tables set forth certain information about compensation paid, earned or accrued for services by (i) the Company’s Chief Executive Officer and (ii) all other executive officers who earned in excess of $100,000 in the years ended December 31, 20202023, 2022, and 20192021 (“Named Executive Officers”):

SUMMARY COMPENSATION TABLE | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Change in |

|

|

|

|

|

| ||||

Kevin Moore, |

| 2020 |

|

| 213,000 |

|

| -0- |

| -0- |

| -0- |

|

| -0- |

| -0- |

| -0- |

|

|

| 213,000 |

| ||

CEO (2)(11) |

| 2019 |

|

| 39,508 |

|

| -0- |

| -0- |

|

| 240,779 |

|

| -0- |

| -0- |

| -0- |

|

|

| 280,287 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

David Gandini, |

| 2020 |

|

| 185,000 |

|

| -0- |

| -0- |

| -0- |

|

| -0- |

| -0- |

| -0- |

|

|

| 185,000 |

| ||

CFO, CRO and Secretary (3) |

| 2019 |

|

| 29,417 |

|

| -0- |

| -0- |

|

| 215,018 |

|

| -0- |

| -0- |

| -0- |

|

|

| 244,435 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Dean Watson, CTO(10) |

| 2020 |

|

| 43,750 |

|

| -0- |

| -0- |

| -0- |

|

| -0- |

| -0- |